Hello PancakeSwap family!

PancakeSwap is thrilled to announce the introduction of our latest collaboration with Range Protocol, following the successful launch of our Position Manager at the end of October. As the first Position Manager to offer vaults on Ethereum, Range Protocol provides various LP managing options for users. This article will guide you on how to utilize their "Trio" strategies across various trading pairs, simplifying your liquidity provisioning in PancakeSwap v3. Learn how to maximize your returns according to your risk tolerance with these innovative strategies.

Additionally, in celebration of our latest strategy integration, liquidity providers employing the Range Protocol strategy will be eligible for bonus CAKE rewards over the following two weeks (further details provided below). Take advantage of this opportunity to boost your earnings!

About Range Protocol Vaults

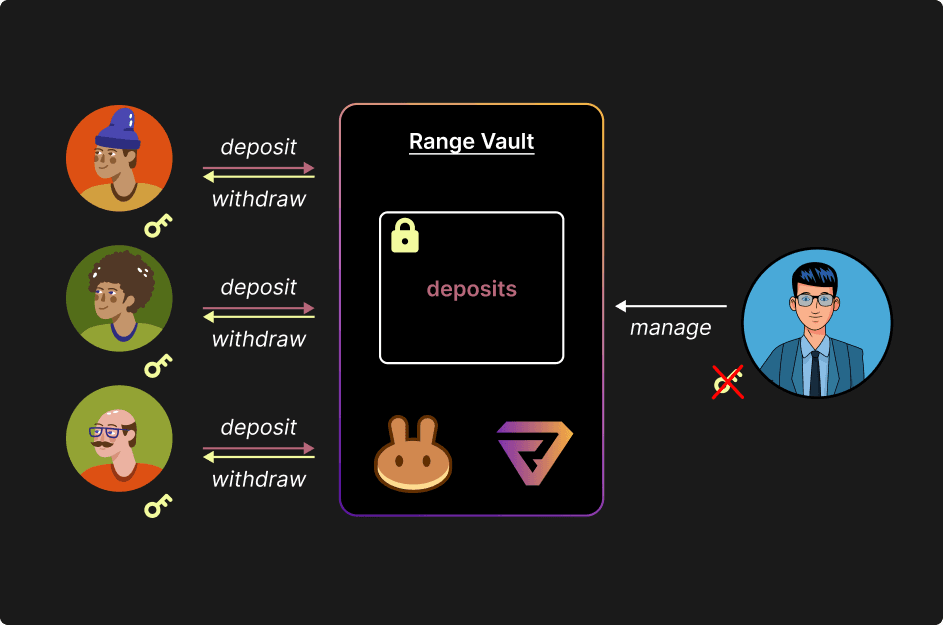

Range Protocol is building the first-of-its-kind Universal On-chain Asset Management Platform, providing the gateway for users to access systematic strategies run by professional asset managers, in a fully non-custodial, trustless manner.

Range’s Automated Liquidity Management vaults are a non-custodial, transparent and efficient solution for everyone who would like to earn yield on their DeFi assets.

Graphic provided by Range Protocol

Graphic provided by Range Protocol

For example, Alice wants to put money into a concentrated liquidity AMM pool to earn trading fees, but she often ends up losing money due to impermanent loss. She knows Bob is skilled at managing liquidity with his advanced algorithms and tools, but she's worried he could steal her money. To solve this, Alice puts her money into a special account (a Vault), where Bob can manage the liquidity by adjusting the positions in the pool, but he can't withdraw the money. This keeps Alice's investment secure. If Bob's management results in profits that outweigh the losses, he charges management fees as an incentive. Ultimately, both Alice and Bob benefit from this arrangement.

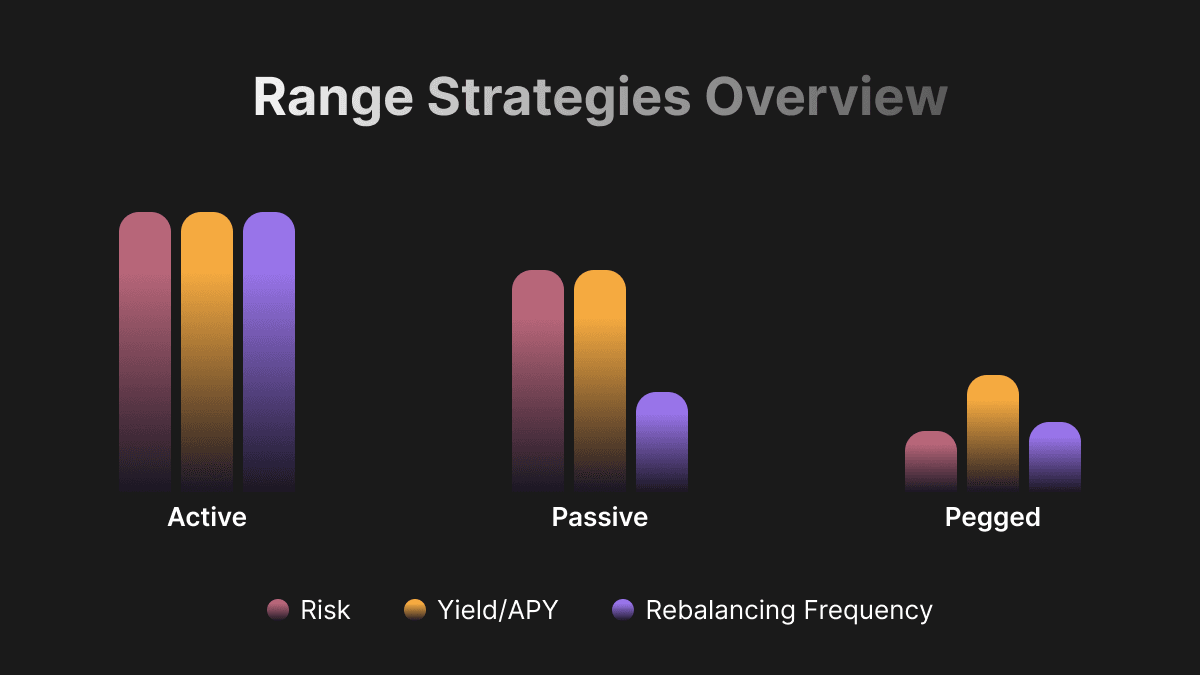

Range Protocol offers three different strategy types for the same trading pair: Active, Passive, and Pegged. Pick the right strategy for you!

Graphic provided by Range Protocol

Graphic provided by Range Protocol

1. Active strategy

Target users: LPs with higher risk tolerance, expecting greater returns.

- Focuses on narrow price ranges to maximize trading fees.

- Reduces impermanent loss by rebalancing to maintain base token exposure when positions leave the range.

- Fully automated, monitoring prices across various platforms every few seconds.

- Uses passive windows during high volatility to lessen impermanent loss and minimize toxic flow.

- Optimizes rebalances in high slippage pools with Just-in-Time Liquidity for zero-slippage swaps.

2. Passive Strategy

Target users: LPs with low/medium-risk tolerance.

- The vault provides the assets in a wide range around the current price.

- The position is expected to stay within range for a long time.

- Vault managers may choose to do rebalancing depending on market conditions.

3. Pegged Strategy

Target users: LPs who hold low risk coins like stablecoins or staking tokens and would like optimal yield generation with low risk.

- For hard-pegged pairs (e.g., USDT-USDC), it provides liquidity in a narrow range, expecting mean reversion without rebalancing unless the price remains out of range too long.

- For soft-pegged pairs (e.g., wstETH-ETH), it actively tracks the asset price, offering liquidity in a very narrow range with potential frequent rebalances.

How Range Protocol’s Trio strategies work on PancakeSwap v3

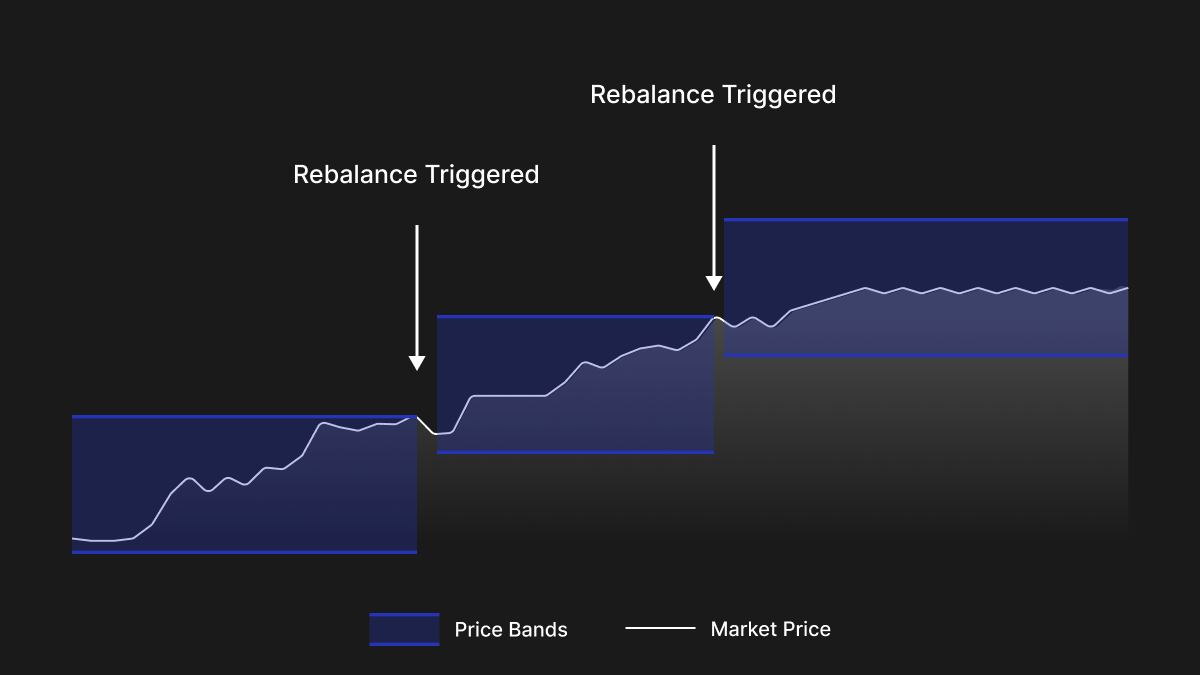

Concentrated liquidity pools offer a strategic way for users to maximize trading fees through fixed price ranges. This approach is lucrative when the asset price remains within the set range, but risks impermanent loss and loss of trading fees if it deviates. Range’s vault managers excel in adapting to market changes through effective backtesting and just-in-time (JIT) liquidity rebalancing, ensuring optimal returns and minimal rebalancing costs.

Range Protocol offers diverse strategies such as Active, Passive, and Pegged, each tailored to different risk-reward profiles. Active strategies focus on narrow price bands for higher fee generation but carry a higher risk of impermanent loss. In contrast, Passive strategies operate within broader price bands, offering lower fees but reduced risk. The Pegged strategies are ideal for those holding pegged asset pairs, balancing optimal yield with low risk.

Range Protocol offers diverse strategies such as Active, Passive, and Pegged, each tailored to different risk-reward profiles. Active strategies focus on narrow price bands for higher fee generation but carry a higher risk of impermanent loss. In contrast, Passive strategies operate within broader price bands, offering lower fees but reduced risk. The Pegged strategies are ideal for those holding pegged asset pairs, balancing optimal yield with low risk.

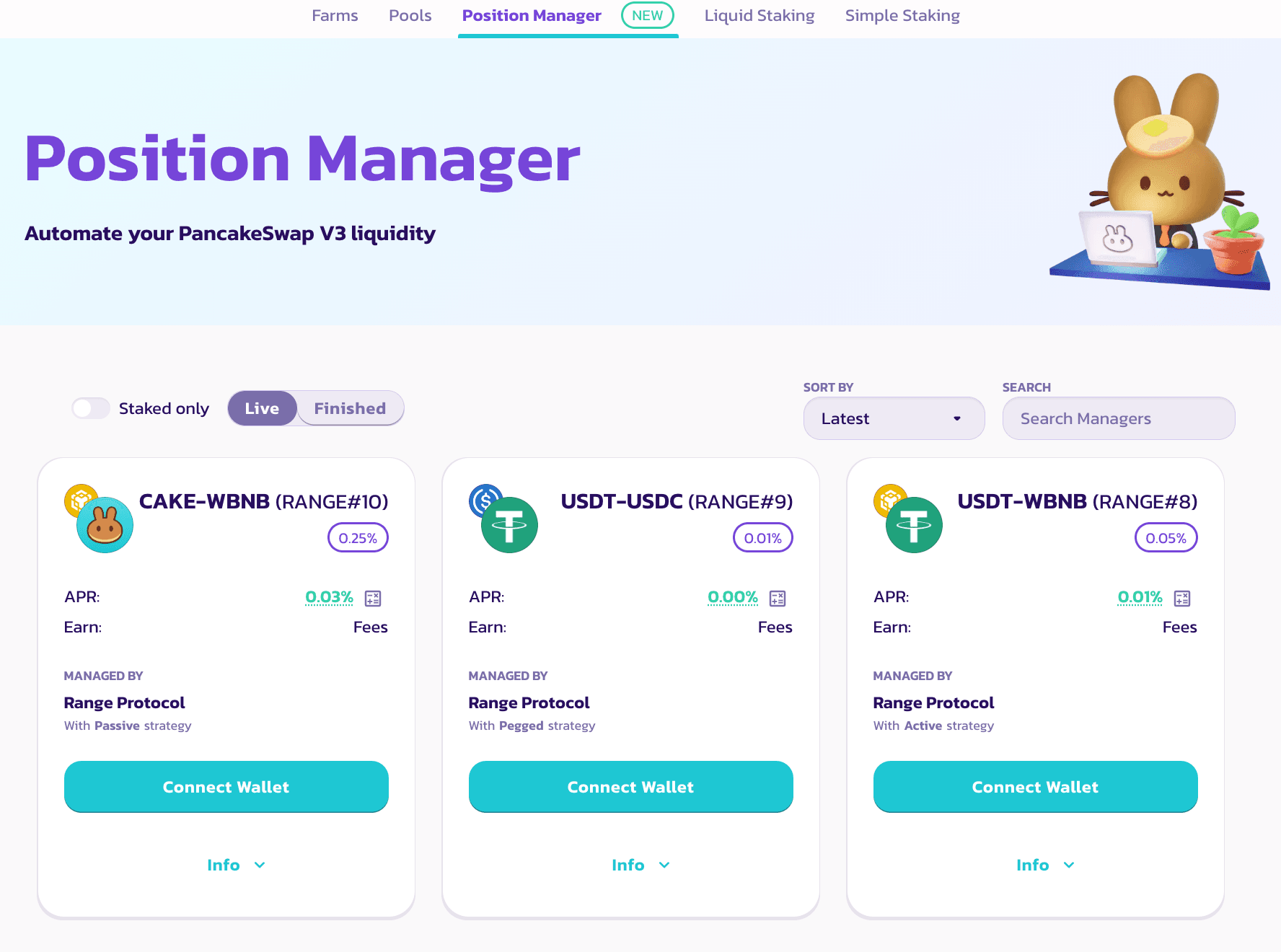

How to use Position Manager on PancakeSwap with Range Protocol’s Strategies:

1. Visit our Position Manager Page.

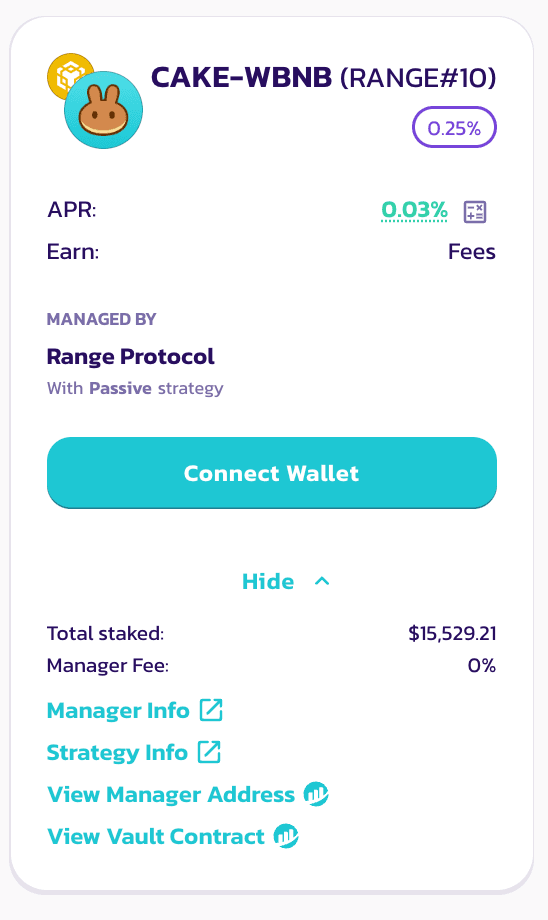

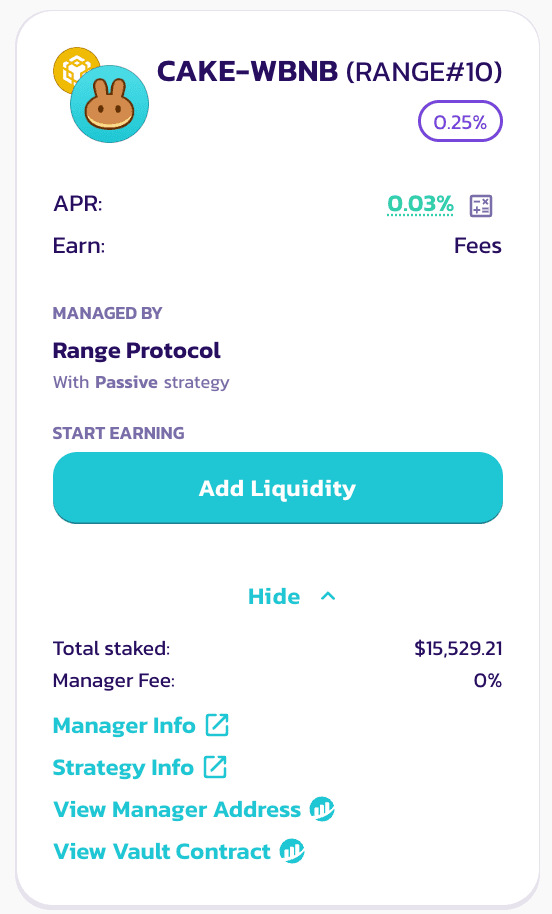

2. In this case, we'll choose the pairs marked as "managed by Range Protocol'' to try out their strategies.

3.Once you've chosen the trading pair with its respective strategy (active/passive/pegged), click on the "Add Liquidity" tab.

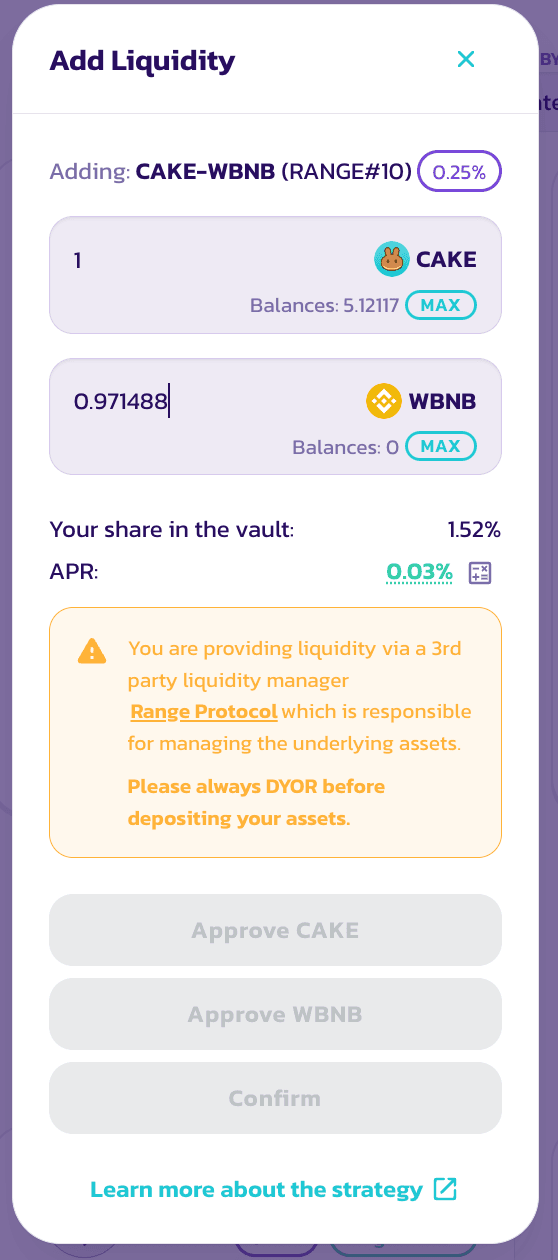

4. A dropdown will appear displaying the needed deposit token, info about APR, and the management fee for the strategy provider. Specify the quantity of the token you wish to deposit and then select "Approve [Token]".

5. Review the details once more, and then click "Confirm".

You've on your way to savoring rewards from both trading fees and additional CAKE yields!

How to collect rewards, add or remove liquidity

Harvesting rewards, adding or removing liquidity is just as straightforward as usual. For a comprehensive farming guide, please visit: https://blog.pancakeswap.finance/articles/how-to-farm-on-pancake-swap-v3-a-comprehensive-guide.

Special Promotion: Additional CAKE Rewards for Early Participants!

To celebrate the launch of the Range Protocol strategy, we're excited to present a special offer for our community. From 16th November at 12:00 UTC to 30th November at 12:00 UTC, liquidity providers using the Range Protocol strategy will have the opportunity to share in a pool of 2,250 CAKE rewards. We've set up incentives for various vaults on both the BNB Chain and Ethereum:

Incentivized Vaults on BNB Chain:

- USDT-WBNB (0.05%) Passive: 15% of total CAKE incentives

- USDT-WBNB (0.05%) Active: 10% of total CAKE incentives

- USDT-USDC (0.01%) Pegged: 10% of total CAKE incentives

- CAKE-WBNB (0.25%) Passive: 20% of total CAKE incentives

Incentivized Vaults on Ethereum:

- rETH-WETH (0.05%) Pegged: 20% of total CAKE incentives

- USDT-USDC (0.01%) Pegged: 10% of total CAKE incentives

- WETH-USDT (0.05%) Passive: 15% of total CAKE incentives

Don't miss this fantastic two-week opportunity to maximize your earnings. Dive into the Range Protocol strategy today and experience the benefits!

Support PancakeSwap's Position Manager

PancakeSwap's Position Manager is engineered to offer LPs a streamlined experience, minimizing losses while amplifying gains. For deeper insights into its functionality and our affiliations, please refer to our announcement blog.

Enjoy!

The Chefs